This document describes present functionality’s of the PM module. This « horizontal » application gives a set of tools to manage the various interest, Forex and cash management risks. Using its own historical data files, it is provided with many enquiries covering these three risks.

Introduction

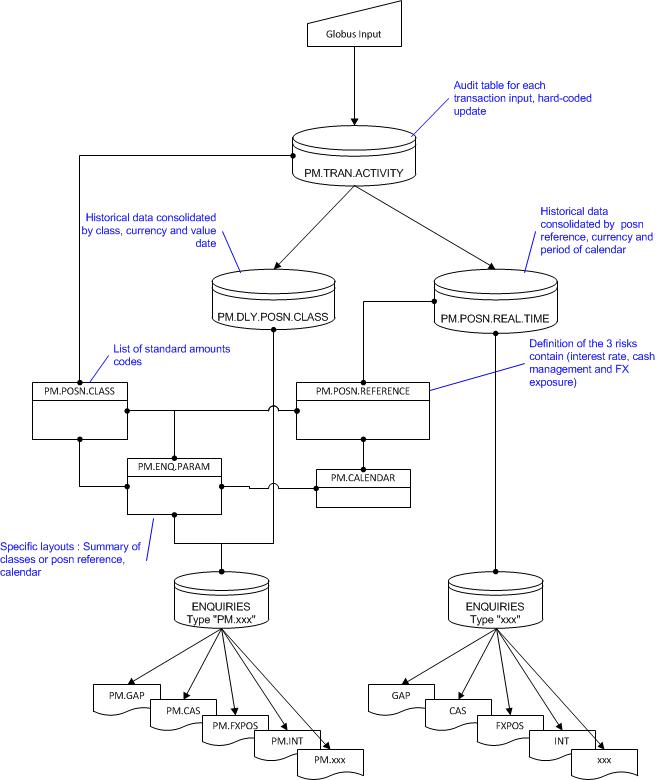

This module is based on queries (enquiries ) that can be modified with various codes (classes), and whose calculation routines are pre-defined. It uses its own historical data files. Operating on real time, transactions updates are done before authorisation. Mortgages and Fiduciaries modules are excluded at this date. The online update of PM.TRAN.ACTIVITY is hard-coded.

A standard is given for each enquiry :

CAS (forecasted cash flow management), NOS (Nostro Position), GAP (interest Gap sheet), NPV ( Net Present Values for interest based products), FXP (Forex Position), DURATION ( :-), … the list is completed regularly from a release to another. In G11, some new enquiries have been provided.

This complement the LIMIT module that manages counterparty, country, currency and commodities risks (counterparty is online, the other threes are controled by end of day reports).

The PM.POSN.REFERENCE file describe the contain of the other three risks managed by this application :

Cash Management : key = CAS

Interest Rate Risk : key = GAP

Forex Exposure : key = FXP

e.g. these definitions include all types of amounts associated to each kind of transaction which are supposed to be part of each risk environment to be controlled.

Then, the different enquiries available are using these keys (data) to show them with various representations, thanks to PM.ENQ.PARAM. It exist then « n » possibilities for those three keys, associating calendars (by dates or by periods), different types of calculations (sensitivities, duration, gap, etc… ; FX positions, revaluation on FX, etc… ;Nostro positions, internal accounts, etc…)

Two methods are existing for online enquiries (until G11):

The « classical » one, using the PM.POSN.REFERENCE file for classes definitions to be used, and PM.POSN.REAL.TIME file for retrieving consolidated data. It is shown in in the logical model. Changes of parameters are impacted after End of Day process (Batch).

The « new», one consolidating historical data of PM.DLY.POSN.CLASS when executing enquiries as PM.CAS, etc…, It may use PM.POSN.REFERENCE records or use its own classes in PM.ENQ.PARAM records, and is shown in in the logical model. It is slightly longer than during the enquiry retrieval, but includes parameters changes on real time (classes).

NB : In G11, a major update of the module has been made and then all enquiries are know driven to the unique PM.DLY POSN.CLASS file. A patch ref. PMP0283 is also available for a G 10.2.02.

More tables than shown in the logical model are existing :

PM.xx.PARAM (with xx corresponding to modules LD, SW, SC, etc…) : To define more precisely what classes should contain, e.g. links between functionnal fields and PM codes. The last part « Tips » include some remarks on these tables.

Example : PM.SC.PARAM manage the different process of portfolio of one bank into PM, depending on the accounting type :

For « TRADING », all transactions should be included in a 3 weeks horizon, for « INVESTMENT », the horizon is upto the maturity of securities holdings.

Some modules as AC, TT or MM are hard-coded regarding the classes definitions.

To finish, to include in PM positions not included in a Globus standard application, an external access PM.POSITION.CAPTURE is available. Theses inputs are included into PM historical data using standard PM classes.

Logical Model

PM.POSN.CLASS

These codes for amounts are mostly hard-coded. At this day, LD, AC and FX can be modified by user, giving the possibility to associate either categories, or events to these codes. It is hardly advised to use pre existing definitions.

It is also possible to create Position Classes for activities not included in Globus, and introduced in PM within PM.POSITION.CAPTURE.

Below is an extract from the user guid. A comment to their structure :

Positions 1 and 2 represent modules (MM, LD, SW,…)

If position 3 is a letter between A and E, positions 3 and 4 give an indication for « accounts » e.g.: BS for Nostro, AS for clients or internal accounts.

If position 3 is a letter greater than E, positions 3 and 4 give an indication for an application other than account. Ex : IN for INterest, SL for Straight Line, …

The last position is described in the user guide (ref PM.DOC – chap. 24-48).

Extracts from the PM User Guide, regarding classes codification:

The full list of accounting movement last characters is as follows:

v C – Discount taken

v D – Principal Decrease

v F – Forward FX

v H – Hedge FRAs

v I – Principal Increase

v I – Interest FX interest hedge

v M – Principal at maturity

v P – Principal repayment LDs

v P – Principal FX interest hedce

v R – Principal repayment MM

v S – Principal at start, non FX

v S – Spot FX

v T – Trade FRAs

As it can be seen you need to be very careful when attempting to identify and allocate

accounts related position classes.

Using the Money Market example the last character ‘C’ of the accounting position class will be substituted by the following:

• ‘S’ to signify start ( or principal start)

• ‘M’ to signify maturity ( or principal maturity)

• ‘N’ to signify interest ( or interest capitalisation)

So:

• MMMPS produces an accounting movement defined as MMBSS

• MMMPM produces an accounting movement defined as MMBSM

• MMMIC produces an accounting movement defined as MMBSN

If the class overnight, class on-line spread and class on-line actual fields are set then the above example would produce six accounts related position activities (three on-line

spread and three on-line actual) and three application specific activities.

If more than one PM.AC.PARAM record is defined then the number of accounts related activities will be further increased, i.e. from 6 to 12, if the CATEGORY code of the ACCOUNT is specified on both records.

Using the above example it can be seen that it is very easy to generate rather more

information than is actually necessary.

List of PM.POSN.CLASS recommended for each application

AC: For NON – NOSTRO Accounts –

ACACC = AC-Cash Overnight Valued dated Balance

ACAIC = AC-Cash Overnight Accrued Interest

ACAGG = AC-Gap Overnight Valued dated Balance

ACALG = AC-Gap Overnight Accrued Interest

ACASC = AC-Cash Online Movements Spread.

ACAAC = AC-Cash Online Movements Actual.

ACAHG = AC-Gap Online Movements Spread.

ACAKG = AC-Gap Online Movements Actual.

For NOSTRO accounts –

ACBCC = AC-Cash Overnight Valued dated Balance

ACBIC = AC-Cash Overnight Accrued Interest

ACBGG = AC-Gap Overnight Valued dated Balance

ACBLG = AC-Gap Overnight Accrued Interest

ACBSC = AC-Cash Online Movements Spread.

ACBAC = AC-Cash Online Movements Actual.

ACBHG = AC-Gap Online Movements Spread.

ACBKG = AC-Gap Online Movements Actual.

DC: DCFDC = DC-Currency Position Activity

DCaaa = DC-Cash/Gap Account Activity.

(Entry across an account)

FR: FRFRS = FRA Start

FRFRM = FRA Maturity

FRXLM = FRA Loan of a settled deal

FRXDM = FRA Deposit of a settled deal

FRXNM = FRA Net rate of a settled deal

FRaaC = FRA Settlement

FRaaH = FRA Estimated Settlement – Hedge.

FRaaT = FRA Estimated Settlement – Trade.

FT: FTFFT = FT-Currency Position Activity

FTaaa = FT-Cash/Gap Account Activity

(entry across an Account)

FX: FXFXP = Forex SP and SW/FW rebate FX Position

FXFSW = Forex SW/FW IN/SL FX Position

FXSWS = Forex SW IN/SL Start

FXSWM = Forex SW In/SL Maturity

FXFSP = Forex FW interest hedge FX Position

FXIHS = Forex FW interest hedge gap start (spot)

FXIHM = Forex FW interest hedge gap maturity

FXIMS = Forex FW interest method gap start (spot)

FXIMM = Forex FW interest method gap maturity

FXSLS = Forex FW straight line gap start (spot)

FXSLM = Forex FW straight line gap maturity

FXaaS = Forex Spot Cash/Gap Account Activity.

FXaaF = Forex FW Cash/Gap Account Activity.

FXaaP = Forex FW IHedge Principal Account

Activity.

FXaaI = Forex FW IHedge Interest Account Activity.

ALFAL = Asset Liability Position

LD: LDXST = LD Principal Activity Start – Gap

LDXMG = LD Principal Activity Maturity – Gap

LDXPT = LD Principal Tax

LDXPI = LD Principal Increase – Gap

LDXDG = LD Principal Decrease – Gap

LDXIC = LD Interest Capitalisation

LDXIT = LD Interest Tax

LDXPG = LD Principal Repayment – Gap

LDXCM = LD Commission

LDXCT = LD Commission Tax

LDXCH = LD Charges

LDXFE = LD Fees

LDXFI = LD Forward Fixed Interest

LDXVI = LD Forward Variable Interest

LDaaS = LD Account Activity for Value date

LDaaI = LD Account Activity for Principal Increase

LDaaD = LD Account Activity for Principal Decrease

LDaaM = LD Account Activity for Principal at

Maturity

LDaaP = LD Account Activity for Principal

Repayments

LDaaN = LD Account Activity for Interest Payments

LDaaC = LD Account Activity for Discount Taken

MM MMMPS = MM Principal Activity Start

MMMPM = MM Principal Activity Maturity

MMMPI = MM Principal Increase

MMMPD = MM Principal Decrease/Repayment

MMMRM = MM Rollover Maturity of old period

MMMRS = MM Start of rollover period

MMMIC = MM Interest Capitalisation

MMaaS = MM Account Activity for Value date

MMaaI = MM Account Activity for Principal Increase

MMaaD = MM Account Activity for Principal Decrease

MMaaM = MM Account Activity for Principal at

Maturity

MMaaN = MM Account Activity for Interest at Maturity

MMaaR = MM Account Activity for Interest Payment

SC: SCFSC = SC-Currency Position Activity

SCCSM = SC-Cash Flow Position Principal

Activity – Maturity (from PM.SC.Param)

SCGSM = SC-Gap Position Activity – Maturity

(from PM.SC.Param)

SCSCI = SC-Cash Flow Position Interest

Activity – Maturity

SCaaa = SC -Account Activity (from deal).

TT: TTFXP = TT- Currency Position Activity

TTaaa = TT- Account Activity.

(entry across an Account)

Detailed explanation for each of these position class ID’s :

1. Account

ACACC = This represents the code which is associated to the cash

activity record relating to the value dated balance as

opening of business of Non Nostro Accounts.

This class can be used as base for account movements at

application level, when no spreading of movements over

time is required.

ACAIC = This represents the code which is associated to the cash

activity record relating to the amount of accrued interest

and charges outstanding on Non Nostro Accounts.

ACAGG = This represents the code which is associated to the

interest mismatch (gap) activity record relating to the

value dated balance as at the opening of business of Non

Nostro accounts.

This class can be used as base for account movements at

application level, when no spreading of movements over

time is required.

ACALG = This represents the code which is associated to the

interest mismatch (gap) activity record relating to the

amount of accrued interest and charges outstanding on

Non Nostro Accounts.

ACASC = This represents the code which is the base for cash

account movements at application level, when the

movements are to be spread over time for Non Nostro

Accounts.

ACAAC = This represents the code which is the base for cash

account movements at application level, when movements

are being spread over time and to allow for case where

the actual movement is required this class is used for Non

Nostro Accounts.

ACAHG = This represents the code which is the base for interest

mismatch (gap) account movements at application level,

when the movements are to be spread over time for Non

Nostro Accounts.

ACAKG = This represents the code which is the base for interest

mismatch (gap) account movements at application level,

when movements are being spread over time and to allow

for case where the actual movement is required this class

is used for Non Nostro Accounts.

ACBCC = This represents the code which is associated to the cash

activity record relating to the balance of Nostro

accounts.

This class can be used as base for account movements at

application level, when no spreading of movements over

time is required.

ACBIC = This represents the code which is associated to the cash

activity record relating to the amount of accrued interest

and charges outstanding on Nostro Accounts.

ACBGG = This represents the code which is associated to the

interest mismatch (gap) activity record relating to the

value dated balance as at the opening of business of

Nostro accounts.

This class can be used as base for account movements at

application level, when no spreading of movements over

time is required.

ACBLG = This represents the code which is associated to the

interest mismatch (gap) activity record relating to the

amount of accrued interest and charges outstanding on

Nostro Accounts.

ACBSC = This represents the code which is the base for cash

account movements at application level, when the

movements are to be spread over time for Nostro

Accounts.

ACBAC = This represents the code which is the base for cash

account movements at application level, when movements

are being spread over time and to allow for case where

the actual movement is required this class is used for

Nostro Accounts.

ACBHG = This represents the code which is the base for interest

mismatch (gap) account movements at application level,

when the movements are to be spread over time for Nostro

Accounts.

ACBKG = This represents the code which is the base for interest

mismatch (gap) account movements at application level,

when movements are being spread over time and to allow

for case where the actual movement is required this class

is used for Nostro Accounts.

2 Data Capture

DCFDC = This represents the code which will be associated to the

currency activity record generated from a Data Capture

entry, impacting the Asset & Liability currency position.

DCaaa = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated from

any Data Capture entry for an Account.

3 Future Rate Agreement

FRFRS = This represents the code which will be associated to the

(notional) PRINCIPAL activity record existing for the

START (value date) of a FRA transaction.

FRFRM = This represents the code which will be associated to the

(notional) PRINCIPAL activity record existing for the

MATURITY (maturity date) of a FRA transaction.

FRXLM = This represents the code which will be associated to the

Principal GAP Loan activity. Value dated to the maturity

of the FRA transaction.

FRXDM = This represents the code which will be associated to the

Principal GAP Deposit activity. Value dated to the

maturity of the FRA transaction.

FRXNM = This represents the code which will be associated to the

Principal net GAP activity. Value dated to the maturity

of the FRA transaction i.e. the rate difference between

FRXLM and FRXDM.

FRaaC = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the Settlement amount existing on the settlement (value)

date of a FRA transaction.

FRaaH = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the estimated settlement on a hedge deal.

FRaaT = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the estimated settlement on a trade deal.

4 Funds Transfer

FTFFT = This represents the code which will be associated to the

Currency activity records generated from a Funds

Transfer Transaction impacting the Asset & Liability

Currency Position.

FTaaa = This represents the code which will be associated to the

Cash/Gap activity record generated from any Funds

Transfer transaction. A Cash activity record is only

raised when the associated accounting entry is for an

Account.

5 FOREX

FXFXP = This represents the code which will be associated to the

activity record deriving from a SPOT forex contract or a

FORWARD/SWAP forex contract using the Rebate

revaluation Method.

FXFSW =

This represents the code which will be associated to the

activity record deriving from a FORWARD/SWAP forex

contract using the Interest or Straight Line revaluation

method. This activity record is used essentially to

produce the currency position information.

FXSWS = This represents the code which will be associated to the

activity record deriving from the SPOT leg of a SWAP

contract using the Interest or Straight Line revaluation

method. This record corresponds to the START activity

and is used essentially to produce, interest mismatch

information.

FXSWM = This represents the code which will be associated to the

activity record deriving from the FORWARD LEG of a

SWAP contract This record corresponds to the

MATURITY activity and is used essentially to produce

interest mismatch information.

FXFSP = This represents the code which will be associated to the

activity record deriving from a FORWARD forex contract

using the Interest Hedge revaluation method. This

activity record is used essentially to produce the

currency position information.

FXIHS = This represents the code which will be associated to the

activity record deriving from the SPOT date of a

FORWARD contract using the Interest Hedge revaluation

method. This record corresponds to the START activity

and is used essentially to produce, interest mismatch

information.

FXIHM = This represents the code which will be associated to the

activity record deriving from the VALUE date of a

FORWARD contract using the Interest Hedge revaluation

method. This record corresponds to the MATURITY

activity and is used essentially to produce, interest

mismatch information.

FXIMS = This represents the code which will be associated to the

activity record deriving from the SPOT date of a

FORWARD contract using the Interest Method revaluation

method. This record corresponds to the START activity

and is used essentially to produce, interest mismatch

information.

FXIMM = This represents the code which will be associated to the

activity record deriving from the VALUE date of a

FORWARD contract using the Interest Method revaluation

method. This record corresponds to the MATURITY

activity and is used essentially to produce, interest

mismatch information.

FXSLS = This represents the code which will be associated to the

activity record deriving from the SPOT date of a

FORWARD contract using the Straight Line revaluation

method. This record corresponds to the START activity

and is used essentially to produce, interest mismatch

information.

FXSLM = This represents the code which will be associated to the

activity record deriving from the VALUE date of a

FORWARD contract using the Straight Line revaluation

method. This record corresponds to the MATURITY

activity and is used essentially to produce, interest

mismatch information.

FXaaS = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the Forex Spot deal or the Spot leg of a swap deal.

FXaaF = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the Forex Forward deal, where the revaluation method is

other than IH for the Forward leg of a swap deal.

FXaaP = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the notional principal on a Forex Forward deal, where the

revaluation method is IH.

FXaaI = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the notional interest on a Forex Forward deal, where the

revaluation method is IH.

ALFAL = This represents the code which will be associated to the

Asset and Liability Currency Position.

6 Loans and Deposits

LDXST = This represents the code which will be associated to the

PRINCIPAL activity record existing for the START

(value date) of a Loan or Deposit Transaction.

LDXMG = This represents the code which will be associated to the

PRINCIPAL activity record existing for the MATURITY

(maturity date) of a Loan or Deposit transaction for

inclusion in the interest mismatch information.

LDXPT = This represents the code which will be associated with

any TAX deducted from principal activities within a Loan

or Deposit transaction.

LDXPI = This represents the code which will be associated to the

Principal activity record, existing for the INCREASE in

principal and will be for Value Date of principal increase.

LDXDG = This represents the code associated with a reduction in

principal for inclusion in the Gap Analysis.

LDXIC = This represents the code which will be associated to the

INTEREST activity record existing when a contract

reaches its interest review date and interest is being

capitalised. The date associated with this activity will be

either the maturity date of the contract if the contract

has a fixed maturity date and there are no interest

schedules or the date of the next interest schedule or the

next interest payment date if it is a call or notice

contract.

LDXIT = This represents the code which will be associated with

any TAX to be deducted from interest on a Loan or

Deposit transaction and will contain a date equal to the

next interest payment date.

LDXPG = This represents the code associated with any

SCHEDULED REPAYMENTS that are due to take place

during the life of a Loan or Deposit transaction. Code is

for inclusion in the interest mismatch information.

Note: If there is a rate revision schedule or rate change date set on the Loan and Deposit record, then an LDXPG will be raised for this date with amount of outstanding principal as at that date. There will be no LDXPG records for future repayment schedule dates and no LDXMG for final maturity date.

LDXCM = This represents the code associated with any

COMMISSION to be received on a Loan transaction.

LDXCT = This represents the code associated with any TAX amount

to be deducted from commissions receivable on a Loan

transaction.

LDXCH = This represents the code associated with any charge

applicable to a Loan or Deposit transaction.

LDXFE = This represents the code associated with any fees which

may have been defined on a Loan or Deposit Schedule.

LDaaS = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the PRINCIPAL amount for the Value (start) date on a

Loan or Deposit contract.

LDaaI = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

any Principal Increase on a Loan or Deposit contract.

LDaaD = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

any Principal Decrease on a Loan or Deposit contract.

LDaaM = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the Principal at Maturity of a Loan or Deposit contract.

LDaaP = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

any any SCHEDULED REPAYMENTS that are due to take

place during the life of a Loan or Deposit contract.

LDaaN = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

any Interest activity deriving from Loan or Deposit

transaction. The date associated with this activity will

be either the maturity date of the contract if the contract

has a fixed maturity date and there are no interest

schedules or the date of the next interest schedule or the

next interest payment date if it is a call or notice

contract.

LDaaC = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the Discount taken at the start of a Loan or Deposit

contract.

7 Money Market

MMMPS = This represents the code which will be associated to the

PRINCIPAL activity record existing for the START

(value date) of a Money Market Transaction.

MMMPM = This represents the code which will be associated to the

PRINCIPAL activity record existing for the MATURITY

(maturity date) of a Money Market transaction.

MMMPI = This represents the code which will be associated to the

Principal activity record, existing for the INCREASE in

principal and will be for Value Date of principal increase.

MMMPD = This represents the code which will be associated to the

Principal activity record existing for repayment of

principal through either MM.PAYMENT.ENTRY (for

Liability Contract) or through MM.RECEIPT.ENTRY (for

Asset Contract) and will be for the Value Date of

principal repayment.

MMMRM = This represents the code which will be associated to the

PRINCIPAL activity record existing for the maturity of

old (original) deal with value date of the old maturity

date.

MMMRS = This represents the code which will be associated to the

PRINCIPAL activity record existing for the start of the

new period of a rolled over contract. The value date will

be for the old (original) maturity date.

MMMIC = This represents the code which will be associated to the

INTEREST activity record existing when a contract is

being rolled over and interest is being capitalised. The

date will be the rollover date for the contract.

MMaaS = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the PRINCIPAL amount for the Value (start) date on a

Money Market contract.

MMaaI = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

any Principal Increase on a Money Market contract.

MMaaD = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the Principal activity record existing for repayment of

principal through either MM.PAYMENT.ENTRY (for

Liability Contract) or through MM.RECEIPT.ENTRY (for

Asset Contract) and will be for the Value Date of

principal repayment.

MMaaM = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the Principal at Maturity of a Money Market contract.

MMaaN = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the INTEREST activity record deriving from a money

market transaction. The date associated with this

activity will be the maturity date of the contract if the

contract has a fixed maturity date or the next interest

payment date if it is a call or notice contract.

MMaaR = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the INTEREST activity record existing for the

repayment of interest on an asset Contract through

MM.RECEIPT.ENTRY and will be for the value date of

principal repayment.

8 Securities

SCFCS = This represents the code which will be associated to the

Currency activity record generated from a Securities

Transaction impacting the Asset & Liability Currency

position.

SCCSM = This represents the code which is associated to the

Principal Cash activity record relating to the maturity of

a security deal outgoing in the bank’s own position.

SCGSM = This represents the code which is associated to the

Principal Interest Mismatch (gap) activity record relating

to the maturity of a security deal outgoing in the bank’s

own position.

SCSCI = This represents the code which is associated to the cash

Interest activity record relating to the maturity of a

security deal outgoing in the bank’s own position.

SCaaa = This represents the code(s) which will be associated to

the cash/gap account activity record(s) generated for

the for Securities movement at Security trade level.

9 Teller

TTFXP = This represents the code which will be associated to the

Currency activity records generated from a Teller

Transaction impacting the Asset & Liability Currency

Position.

TTaaa = This represents the code which will be associated to the

Cash/Gap activity record generated from any Teller

transaction. A Cash activity record is only raised when

the associated accounting entry is for an Account.

The list of Position Classes that would be required if there were a CASH and GAP requirement to spread the online movements for all applications and to have a split between Non Nostro and Nostro Accounts. The base Position Classes are taken to be:-

ACASC Cash Non Nostro Accounts.

ACAHG Gap Non Nostro Accounts.

ACBSC Cash Nostro Accounts.

ACBHG Gap Nostro Accounts.

The other Position Class required are: –

DC: DCASC = DC – Cash Non Nostro Accounts.

DCAHG = DC – Gap Non Nostro Accounts.

DCBSC = DC – Cash Nostro Accounts.

DCBHG = DC – Gap Nostro Accounts.

FR: FRASC = Settlement Amount. Cash Non Nostro.

FRAHC = Settlement Amount. Gap Non Nostro.

FRBSC = Settlement Amount. Cash Nostro.

FRBHC = Settlement Amount. Gap Nostro.

FRASH = Estimated Settlement Hedge. Cash Non

Nostro.

FRAHH = Estimated Settlement Hedge. Gap Non

Nostro.

FRBSH = Estimated Settlement Hedge. Cash Nostro.

FRBHH = Estimated Settlement Hedge. Gap Nostro.

FRAST = Estimated Settlement Trade. Cash Non

Nostro.

FRAHT = Estimated Settlement Trade. Gap Non Nostro.

FRBST = Estimated Settlement Trade. Cash Nostro.

FRBHT = Estimated Settlement Trade. Gap Nostro.

FT: FTASC = FT – Cash Non Nostro Accounts.

FTAHG = FT – Gap Non Nostro Accounts.

FTBSC = FT – Cash Nostro Accounts.

FTBHG = FT – Gap Nostro Accounts.

FX: FXASS = Spot Deals. Cash Non Nostro.

FXAHS = Spot Deals. Gap Non Nostro.

FXBSS = Spot Deals. Cash Nostro.

FXBHS = Spot Deals. Gap Nostro.

FXASF = Forward non IH deals. Cash Non Nostro.

FXAHF = Forward non IH deals. Gap Non Nostro.

FXBSF = Forward non IH deals. Cash Nostro.

FXBHF = Forward non IH deals. Gap Nostro.

FXASP = Notional Principal IH deals. Cash Non

Nostro.

FXAHP = Notional Principal IH deals. Gap Non Nostro.

FXBSP = Notional Principal IH deals. Cash Nostro.

FXBHP = Notional Principal IH deals. Gap Nostro.

FXASI = Notional Interest IH deals. Cash Non Nostro.

FXAHI = Notional Interest IH deals. Gap Non Nostro.

FXBSI = Notional Interest IH deals. Cash Nostro.

FXBHI = Notional Interest IH deals. Gap Nostro.

LD: LDASS = Principal Start. Cash Non Nostro.

LDAHS = Principal Start. Gap Non Nostro.

LDBSS = Principal Start. Cash Nostro.

LDBHS = Principal Start. Gap Nostro.

LDASI = Principal Increase. Cash Non Nostro.

LDAHI = Principal Increase. Gap Non Nostro.

LDBSI = Principal Increase. Cash Nostro.

LDBHI = Principal Increase. Gap Nostro.

LDASD = Principal Decrease. Cash Non Nostro.

LDAHD = Principal Decrease. Gap Non Nostro.

LDBSD = Principal Decrease. Cash Nostro.

LDBHD = Principal Decrease. Gap Nostro.

LDASM = Principal at Maturity. Cash Non Nostro.

LDAHM = Principal at Maturity. Gap Non Nostro.

LDBSM = Principal at Maturity. Cash Nostro.

LDBHM = Principal at Maturity. Gap Nostro.

LDASP = Principal Repayments. Cash Non Nostro.

LDAHP = Principal Repayments. Gap Non Nostro.

LDBSP = Principal Repayments. Cash Nostro.

LDBHP = Principal Repayments. Gap Nostro.

LDASN = Interest Payments. Cash Non Nostro.

LDAHN = Interest Payments. Gap Non Nostro.

LDBSN = Interest Payments. Cash Nostro.

LDBHN = Interest Payments. Gap Nostro.

LDASC = Discount Taken. Cash Non Nostro.

LDAHC = Discount Taken. Gap Non Nostro.

LDBSC = Discount Taken. Cash Nostro.

LDBHC = Discount Taken. Gap Nostro.

MM MMASS = Principal Start. Cash Non Nostro.

MMAHS = Principal Start. Gap Non Nostro.

MMBSS = Principal Start. Cash Nostro.

MMBHS = Principal Start. Gap Nostro.

MMASI = Principal Increase. Cash Non Nostro.

MMAHI = Principal Increase. Gap Non Nostro.

MMBSI = Principal Increase. Cash Nostro.

MMBHI = Principal Increase. Gap Nostro.

MMASD = Principal Repayment. Cash Non Nostro.

MMAHD = Principal Repayment. Gap Non Nostro.

MMBSD = Principal Repayment. Cash Nostro.

MMBHD = Principal Repayment. Gap Nostro.

MMASM = Principal at Maturity. Cash Non Nostro.

MMAHM = Principal at Maturity. Gap Non Nostro.

MMBSM = Principal at Maturity. Cash Nostro.

MMBHM = Principal at Maturity. Gap Nostro.

MMASN = Interest Payments. Cash Non Nostro.

MMAHN = Interest Payments. Gap Non Nostro.

MMBSN = Interest Payments. Cash Nostro.

MMBHN = Interest Payments. Gap Nostro.

MMASR = Interest Repayments. Cash Non Nostro.

MMAHR = Interest Repayments. Gap Non Nostro.

MMBSR = Interest Repayments. Cash Nostro.

MMBHR = Interest Repayments. Gap Nostro.

SC: SCASC = Deal level Movement. Cash Non Nostro.

SCAHG = Deal level Movement. Gap Non Nostro.

SCBSC = Deal level Movement. Cash Nostro.

SCBHG = Deal Level Movement – Gap Nostro.

TT: TTASC = Teller – Cash Non Nostro Accounts.

TTAHG = Teller – Gap Non Nostro Accounts.

TTBSC = Teller – Cash Nostro Accounts.

TTBHG = Teller – Gap Nostro Accounts.

Modifications to PM to be EURO- compatible.

Remind :

PM module is based on

- Enquiries (CAS.BKCP, GAP.BKCP,…) driven to : PM.POSN.REAL.TIME

- PM.POSN.REFERENCE is which classes are set and feeding PM.POSN.REAL.TIME file.

An other set of enquiries (PM.CAS, PM.GAP,…) is existing. It uses an extra table to modify the layout : PM.ENQ.PARAM

In this file, some parameters allow to display all “IN” currencies positions converted into one “EUR” position.

Example of PM.ENQ.PARAM :

PM ENQUIRY PARAMETER SEE

|

Possibility or specific calendars (dates / periods) |

ENQUIRY.NAME…… CAS

—————————————

1. 1 GB DESCRIPTION. CASH FLOW REPORT

|

If populated, parameters for CAS is used. Otherwise, fields 10.x allow specific classes to be used instead. |

2 ONITE/DAILY FILE.. DAILY

3 CALENDAR……….

4 START BREAK……. CAL

5 TAKINGS SIGN…… MINUS

6 PLACINGS SIGN….. PLUS

7 DIF. TAK. SIGN…. MINUS

8 DIF. PLAC. SIGN… PLUS

9 POSN REF FILE….. CAS

10. 1 POSN.CLASS…..

|

If “Yes”, IN amounts are converted and consolidated into EUR |

11. 1 DEAL.DESK……

12 DATE.OR.PERIOD…. DATE

13 COMPANY.CONSOL….

14 CHECK.FILE……..

15. 1 CHECKFILE.IDs..

16 CONVERT.FIXED.CCY.

Execution :

ENQ PM.CAS

test (esc1) G9.0.04 ENQUIRY, INPUT REF PM.CAS

[EQ NE LK UL GT LT GE LE RG NR]

(2)SELECTION (3)OPERAND (4)LIST

<r> CCY EQ EUR

PM.ENQ.PARAM EQ CAS

(6) Pre-set Selection…..

(9.1) Sort Field……….

(10.1) Fixed Selection….

(11.1) Fixed Sort Fields..

12 Print all pages (Y/N)..

Results :

test (esc1) G9.0.04 Cash Flow KEY : EUR

Date Amount In Amount Out Amount Net Amt Carry Fwd

1 30-09-98 +8,858,361.45 -44,466,890.00 -35,608,528.55 -35,608,528.55

2 01-10-98 +67,898,837.36 -120,775,528.70 -52,876,691.34 -88,485,219.89

3 02-10-98 +1,392,170.16 -4,490,777.72 -3,098,607.56 -91,583,827.45

4 05-10-98 +10,000,000.00 -66,375,539.43 -56,375,539.43 -147,959,366.88

5 06-10-98 +0.00 -178,821.11 -178,821.11 -148,138,187.99

6 07-10-98 +76,458,054.27 -34,568,082.18 +41,889,972.09 -106,248,215.90

7 08-10-98 +14,464,901.35 -3,984,178.09 +10,480,723.26 -95,767,492.64

8 09-10-98 +14,472,301.16 -1,581,768.06 +12,890,533.10 -82,876,959.54

Details for 30-09-98 :

test (esc1) G9.0.04 Transaction Details EUR

Value Transaction CCY Transaction Transaction Total In

Date Reference Amount Total EUR

1 30/09/98 DIARSC982720001|.800 -23,239,866

2 DIARSC982720001|.800 23,239,866 0 0.00

3 MM9817700032 DEM 180,324.15

4 MM9817700032 DEM -202.53

5 MM9817700032 DEM 1,147.70 181,269.32 91,671.46

6 MM9823600010 BEF 69,945

7 MM9823600010 BEF 20,000,000 20,069,945 499,040.09

8 MM9823800009 BEF 82,466

9 MM9823800009 BEF 25,000,000 25,082,466 623,676.64

10 MM9823900010 FRF -1,512.00

11 MM9823900010 FRF -540,000.00 -541,512.00 -81,653.11

12 MM9823900011 ITL -4,700,000,000

13 MM9823900011 ITL -19,387,500 -4,719,387,500 -2,449,955.44

14 MM9823900012 XEU -2,500,000.00

1 MM9823900012 XEU -8,500.00 -2,508,500.00 -2,508,500.00

…

1 PM9826700036 FRF 26,997.00 26,997.00 4,070.80

2 PM9826700040 DEM 11,467.00 11,467.00 5,799.09

3 PM9826700049 ATS 8,423.00 8,423.00 614.36

4 PM9826700060 FRF 708,790.00 708,790.00 106,876.50

5 PM9826700069 FRF 134,887.00 134,887.00 20,339.24

6 PM9826700076 DEM 17,712.00 17,712.00 8,957.31

7 PM9826700085 DEM 77,085.00 77,085.00 38,983.40

8 PM9826700094 BEF 54,847,686 54,847,686 1,363,790.18

9 PM9826800029 FRF -13,057.71 -13,057.71 -1,968.94

10 PM9826800056 BEF 30,423,562 30,423,562 756,483.24

35,608,528.55

Total For Period 35,608,528.55

Tips

PM.PARAMETER :

- indicate active modules in PM (# 3.x). Field 2 swho if we are setting up reports (CA), and then re caculation every night of positions, or if they are definitive (NAU), (decreases batch time).

- To include a new module, launch PM.UPDATE.APPL, create a key « ADD » : The batch EOD will add module(s) indicated in the list of application of PM.PARAMETER (fields 3.x). The procedure is identical to remove a module, simply choose the « DELETE » key instead.

Enquiries based on GAP :

- To include Forex swaps, use FXSWM in PM.POSN.REFERENCE.

- For securities, field 10 of PM.SC.PARAM display either the nominal rate, or the Yield to Maturity. This is usefull for zero coupon bonds. The system will then retrieve the field 32 of SECURITY.SUPP. The field 8 define the horizon : for investment portfolios, it is mainly MAT; for trading ones 3W.

- Securities of FRN types are appearing for the next period only, using the current rate. (different from CAS).

Enquiries based on CAS :

- Bug until G11.0.01 : Interest at maturity missing (SCSCI) from PM.TRAN.ACTIVITY.

- Securities of FRN types are appearing until the last period, using the current rate. (different from GAP)

PM.LD.PARAM :

- Field 23 option to project or not schedules until maturity. (time consuming).