Definition

Barrier options are part of exotic options. They differ from standard (or vanilla) options by having extra criteria to determining if they can be activated or not / exercised or not.

With vanilla options the underlying spot price is compared to the strike price to decide whether we exercise it or not. On top of the strike price, exotic options have barrier price(s): can be single or double barrier prices.

During the life of the option, the underlying spot price will be compared to the barrier, as such, exotic options are said “path dependent”.

Types of barriers

in / out

A barrier level will determine if the option is activated or deactivated.

When the spot price crosses an in barrier, the option will be activated.

When the spot price crosses an out barrier, the option will be deactivated.

Up / Down

When traded, the barrier can be above or below the spot price.

Barrier is up when above the spot price.

Barrier is down when below the spot price.

The list of combination of these two types gives 4 types of barrier options:

Down and out

Up and out

Down and in

Up and in

Considering an option can be a Call or a Put, and barrier can be above or below the strike, total of combinations is actually 16.

Terminology

When trading regular barrier options, the barrier is out of the money:

- If the barrier is in, options are called “knock in barrier options”.

- If the barrier is out, options are called “knock out barrier options”.

When trading reverse barrier options, the barrier is in the money:

- If the barrier is in, options are called “kick in barrier” or “reverse knock in” options.

- If the barrier is out, options are called “kick out barrier” or “reverse knock out” options.

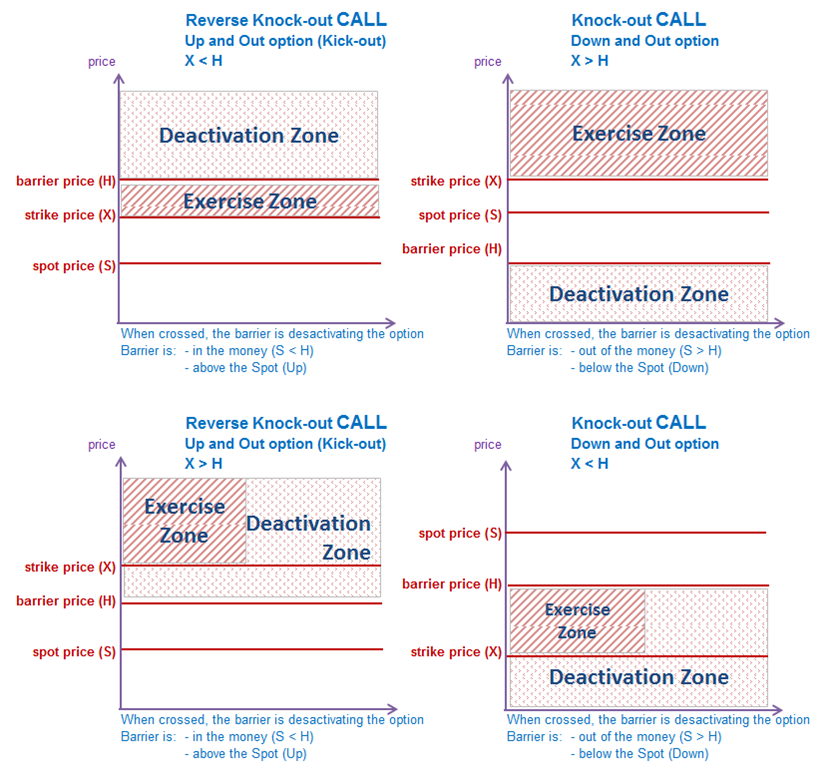

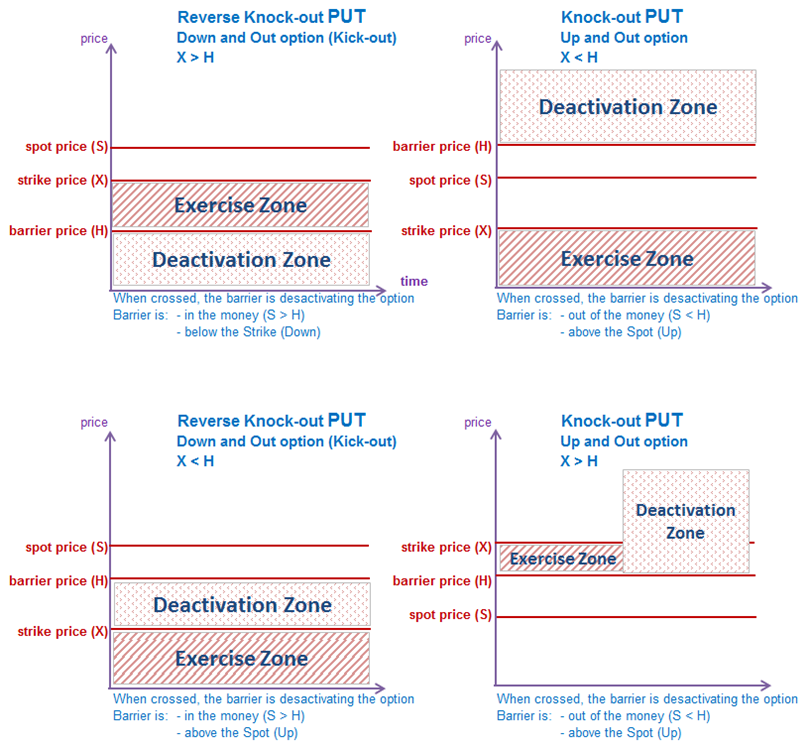

Graphical Summary: the 16 combinations

Knock-out barriers

If the spot price touches the barrier before expiration, options are deactivated.

For CALL options:

For PUT options:

Knock-in barriers:

Once the spot price touches the barrier before expiration, options are activated.

For CALL options:

For PUT options:

Pricing of European single barrier options

Merton (1973) provided the first analytical formula for a down and out CALL option. Then in 1993 Reiner and Rubinstein have developed closed forms to calculate the price of all combinations of European single barrier options. They’ve based the forms on the Black & Scholes framework.

Below “closed forms” can be pretty easily be coded in algorithms.

Pricing closed forms:

Delta closed forms:

Prices for barrier options are given by the following combinations of the A, B, C & D forms. Same rule for Delta.

Knock-out Prices

For Knock-out CALL options:

Down and Out: barrier is out of the money (S > H)

Knock-out CALL with strike < barrier (X < H): B – D

Knock-out CALL with strike > barrier (X > H): A – C

Up and Out: barrier is in the money (S < H)

Reverse Knock-out CALL with strike < barrier (X < H): A – B + C – D

Reverse Knock-out CALL with strike > barrier (X > H): 0

For Knock-out PUT options:

Up and out: barrier is out of the money (S < H)

Knock-out PUT with strike < barrier (X < H): A – C

Knock-out PUT with strike > barrier (X > H): B – D

Down and out: barrier is in the money (S > H)

Reverse Knock-out PUT with strike < barrier (X < H): 0

Reverse Knock-out PUT with strike > barrier (X > H): A – B + C – D

Knock-in Prices

For Knock-in CALL options

Down and in: barrier is out of the money (S > H)

Knock- in CALL with strike < barrier (X < H): A- B + D

Knock- in CALL with strike > barrier (X > H): C

Up and in: barrier is in the money (S < H)

Reverse Knock-in CALL with strike < barrier (X < H): B – C + D

Reverse Knock- in CALL with strike > barrier (X > H): A

For Knock-in PUT options:

Up and in: barrier is out of the money (S < H)

Knock- in PUT with strike < barrier (X < H): C

Knock- in PUT with strike > barrier (X > H): A – B + D

Down and in: barrier is in the money (S > H)

Reverse Knock- in PUT with strike < barrier (X < H): A

Reverse Knock- in PUT with strike > barrier (X > H): B – C + D